The main income of the investor of the SANZA fund comes from the division of profit received by the fund at auction. We trade in accordance with three strategies:

Automated (trading robot)

Medium-term manual trading

Trading fundamental data

The fund manager distributes funds between strategies based on the actual results of profitability/risk on the current market. The control of experienced traders, diversified market-neutral strategies, and special OKX conditions help minimize risks and maximize profits.

Trading robot

Strategy

The trading robot algorithm is based on a trend-following market-neutral strategy, under which the robot enters a position on the breakdown of the formed channel (trading) and closes the position when it reaches the target profit fixation point, or when a signal to enter the opposite direction occurs.

The strategy is independent of market direction. The robot picks up both long (short) and short (short) positions.

The trading algorithm is implemented in short-term (M5) and medium-term (H4) settings, and holds positions in trends from several hours to several weeks.

Position Size Management

The robot forms positions based on the results of previous transactions. If the transaction was unprofitable, the open position is reduced by the amount of the resulting loss, and vice versa.

This logic slows down the decline in capital, and the increase in profitability comes with exponential growth.

Capital Management

The total volume of traded positions does not exceed the size of the deposit. With the continuation of the trend movement, the robot increases a position. The increase occurs under the condition that the profit accumulated during the movement covers the loss of the size of the position increase in the event of a turn in an unfavorable direction.

The robot enters into a deal on the breakdown of the channel. The price moves to the next floor and forms a new channel. In the process of forming a new channel, the robot forms a new level of support, at the breakdown of which it will close the position. The robot places an order to add a position based on the assumption that the accumulated profit will cover a possible loss when the price moves in an unfavorable direction to the formed level of closing the position.

With the continuation of the trend movement, the position is held in an increased volume until the profit fixation point or until the signal for early closure of the position appears. In this case, the position volume can be increased by 2-3 times in relation to the starting position. The amount of profit when closing at the target level may exceed the size of the starting order, that is, more than 100% of the starting order, without risk for the deposit in case of adverse price movement.

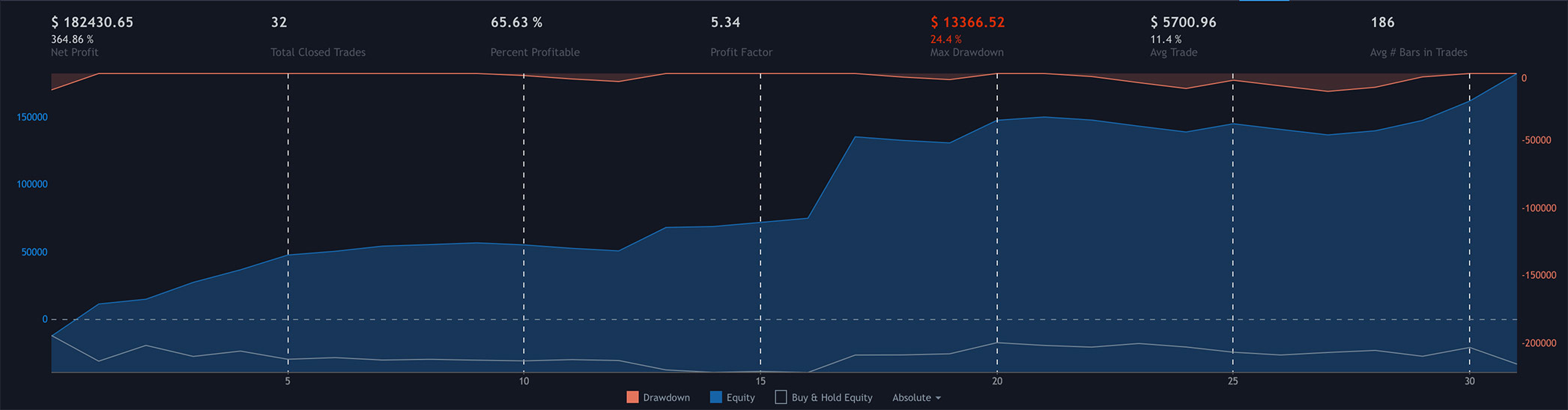

The work of the trading robot since the beginning of 2018 in the BTCUSD pair

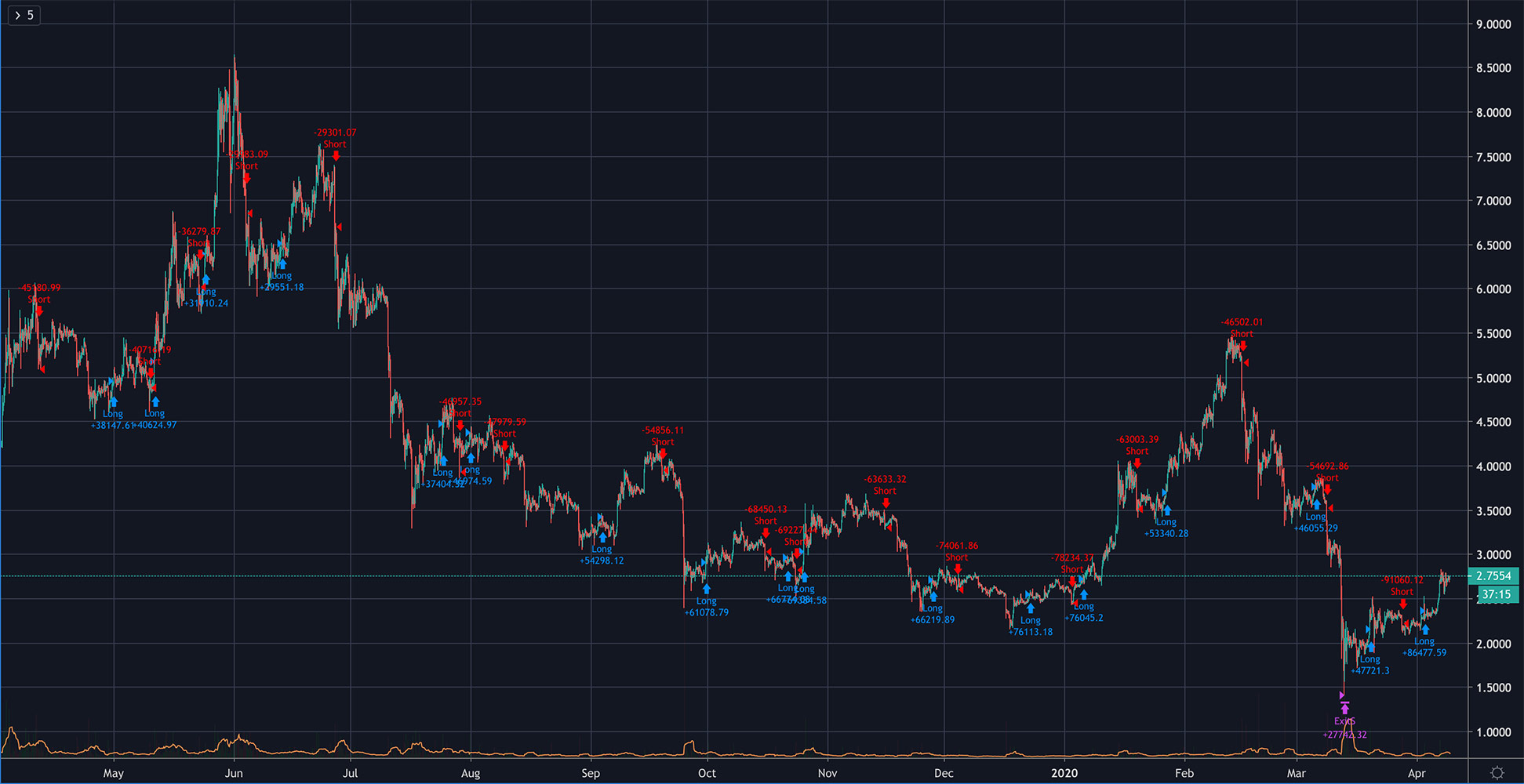

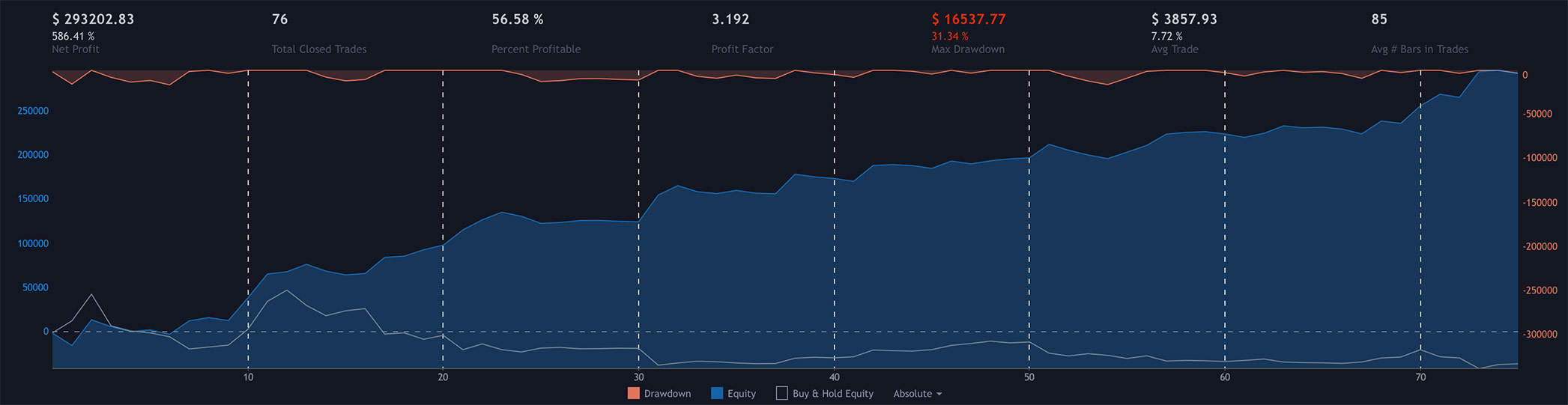

The work of the trading robot since the beginning of 2018 in the EOSUSD pair

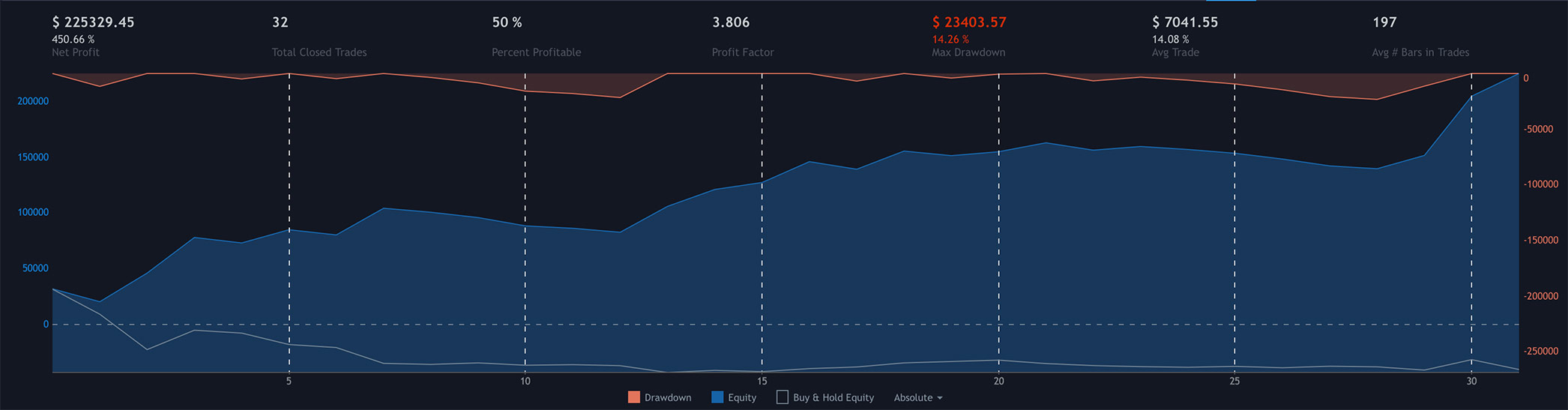

The work of the trading robot since the beginning of 2018 in the ETHUSD pair

Medium-term manual trading

Strategy

A market-neutral trading strategy based on a comprehensive technical assessment of the market, which is difficult to automate. When forming the strategy, we use a combined assessment of levels, channels, fractal zones, volume dynamics, the nature of the order tape and other factors.

To assess the overall price trend, we use D1 and H1 timeframes. To enter the position — M5. Entrance into the transaction is carried out only when the short-term trend coincides with the long-term.

Position formation

The total position volume is divided into 3-5 parts depending on market volatility. The position is added only according to the trend and only upon subsequent confirmation of the basic hypothesis. The volume depends on confirmation of entry by various methods of market assessment. We hold positions up to 5 trading days.

Trading fundamental data

Strategy

The strategy is based on the assessment and interpretation of already published and expected news of a political, regulatory, economic and technical nature.

Positions are opened both on increase (long), and on decrease (short). The core of fundamental data trading is the development of a hypothesis and its confirmation by statistical methods. Only reliable news obtained from primary sources is used to formulate a strategy.

Position management

The total volume of the maximum allowable position is divided into equal parts (at least three). Recruitment is carried out in stages.

Entry into the position in the first part in the presence of a formed hypothesis is carried out using technical analysis methods. Use timeframes from H1 and higher for making entry.

An increase in the position volume is carried out when the basic hypothesis is confirmed by breaking news, i.e. only in trend. When conflicting information appears, the positions are closed. A revision of the basic hypothesis is carried out at least once every 3 days. Position holding time is up to 10 days.

Trading results: Monthly returns

Trading results: Cumulative returns*

*We provide a statement confirming the history of bidding.